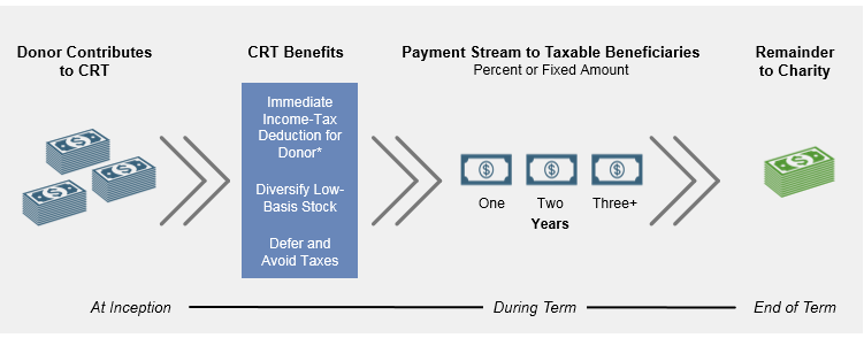

CRTs are a great way to provide a stream of income to you and your loved ones while providing for Florida House’s future operations. In addition to income, CRTs endow you with multiple benefits:

- Immediate tax deductions

- Deferring and avoiding capital gains taxes

CRTs can be set up with your wealth manager and estate planning attorney, who will also manage the CRT. Florida House would be named as a beneficiary and would not be responsible for the oversight of the CRT.

Typically, beneficiaries are not notified when they are included in CRTs. Please let us know of your intention so that we may thank you and keep you informed of our work by completing the form below. Thank you again for your support of Florida House and for being part of the Cherry Blossom Society.

Have questions? Contact Diana Beckmann at (202) 546-1555 or donations@floridahousedc.org.